The Price of Wine: Why Prices Are Rising and What It Means for You

Table of Contents

If you’ve been asking yourself why the price of wine keeps going up, you’re not imagining it — and you’re certainly not alone. Over the past few years, wine prices in the UK have been nudged, shoved and occasionally walloped upwards by a combination of tax changes, rising costs and government policy decisions that feel a long way removed from vineyards in Beaujolais or barrels in the Douro.

And from 1 February 2026, there’s another change coming. Courtesy of the Chancellor — UK alcohol duty will rise again, adding fresh pressure to the price of wine on shelves up and down the country.

Let’s explain what’s changing, why it matters, and why it's mostly out of our control.

The Price of Wine: Death by Economics

The price of wine has never been determined by grapes alone. By the time a bottle reaches your glass, it has passed through a surprisingly long (and increasingly expensive) chain:

- Grapes grown, often by hand, in unpredictable weather

- Wine made, stored and bottled

- Glass produced in energy-hungry furnaces

- Wine shipped across borders

- Imported, declared, taxed and taxed again

- Finally delivered to a shelf or doorstep

Each step costs more than it used to. On their own, none would be disastrous. Together, they explain why the price of wine has been steadily rising — even before we get to tax.

UK Alcohol Duty: The Elephant in the Cellar

If there’s one factor that dominates the modern price of wine in the UK, it’s alcohol duty.

Since August 2023, wine duty has been calculated according to alcohol by volume (ABV). In other words: the stronger the wine, the more tax is paid. This replaced the old, simpler banded system and immediately pushed duty higher for many everyday wines.

Crucially, the system also allows for automatic uprating in line with inflation — which brings us neatly to February 2026.

What Changes on 1 February 2026?

From 1 February 2026, HMRC will increase alcohol duty in line with inflation. Wine, beer and spirits are all affected, but wine is particularly exposed because duty is charged as a fixed amount per bottle.

In practical terms:

- Every bottle of wine sold in the UK will carry more duty

- VAT (20%) is charged on top of the higher duty

- The increase applies regardless of where the wine comes from or how it’s made

It’s not a dramatic overnight shock — more a slow tightening of the screw. But it does mean the price of wine edges upwards once again.

How Much Does Duty Add to the Price of Wine?

This is where things get eye-opening.

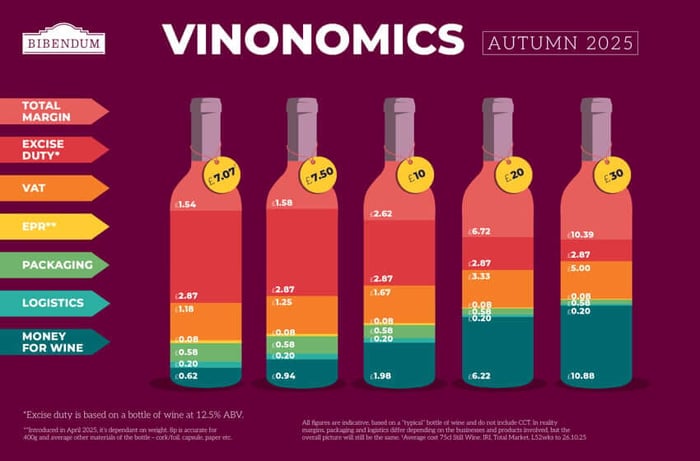

Industry analysis — neatly summarised in Bibendum’s widely shared Vinonomics infographic — shows just how much tax now contributes to the final price of a bottle of wine.

Figure: Vinonomics infographic — typical UK wine cost breakdown

UK Wine Duty by ABV (Before and After 1 February 2026)

To make the impact of duty changes clearer, the table below shows the alcohol duty payable on a standard 75cl bottle of still wine, at 0.5% ABV intervals, comparing rates before and after the February 2026 uprating.

| ABV | Duty before 1 Feb 2026 | Duty after 1 Feb 2026 | Difference |

|---|---|---|---|

| 8.5% | £1.88 | £1.95 | +£0.07 |

| 9.0% | £1.99 | £2.07 | +£0.08 |

| 9.5% | £2.10 | £2.18 | +£0.08 |

| 10.0% | £2.22 | £2.30 | +£0.08 |

| 10.5% | £2.33 | £2.41 | +£0.08 |

| 11.0% | £2.44 | £2.53 | +£0.09 |

| 11.5% | £2.55 | £2.64 | +£0.09 |

| 12.0% | £2.66 | £2.76 | +£0.10 |

| 12.5% | £2.77 | £2.87 | +£0.10 |

| 13.0% | £2.88 | £2.99 | +£0.11 |

| 13.5% | £2.99 | £3.10 | +£0.11 |

| 14.0% | £3.10 | £3.22 | +£0.12 |

| 14.5% | £3.21 | £3.33 | +£0.12 |

| 15.0% | £3.32 | £3.44 | +£0.12 |

Figures shown are duty only (excluding VAT), based on HMRC rates and inflation-linked uprating from 1 February 2026. VAT at 20% is charged on top of these amounts.

On a typical bottle of still wine around 12–13% ABV:

- Duty alone now runs to several pounds per bottle

- VAT is applied on the wine and the duty

- Tax can easily account for well over half the shelf price on lower-priced wines

This is why the price of wine can rise even when producers, importers and merchants are all trying to hold margins steady.

Why the Price of Wine Feels Particularly Painful

Wine duty is regressive. That’s not a political comment — it’s just maths.

- A £9 bottle is hit far harder than a £30 bottle

- Entry-level wines take the biggest knock

- Merchants have very little room to absorb increases

Which is why genuinely cheap wine has become harder to find, and why the bottom rung of the wine ladder keeps disappearing. For those looking to stretch their budget without compromise, check out our great value wines under £15.

What This Means for Wickhams

As an independent wine merchant, we sit uncomfortably between rising costs and customers who quite reasonably don’t want to pay more.

- We don’t race to the bottom

- We don’t apologise for fair pricing

- We focus on wines that justify their price

For those willing to spend a little more, our carefully selected wines between £15 and £30 offer excellent quality and value.

From 1 February 2026, duty increases will take a little more out of every bottle sold in the UK. We’ll keep doing what we’ve always done: explaining why, sourcing carefully, and making sure the wines we sell are worth every penny.

FAQs

Why is the price of wine going up again?

It’s not us, promise. From 1 February 2026, UK wine duty rises in line with inflation, VAT is added on top, and costs across the supply chain keep creeping up. Together, these factors push the price of wine steadily higher.

Will all wines be affected the same way?

Nope. Cheaper wines get hit hardest because there’s less margin to absorb duty. Stronger wines also attract more tax, simply for being stronger — quality or provenance doesn’t factor into HMRC’s arithmetic.

Does this mean there’s no value left in wine under £15?

Not at all. There are still great value wines under £15, but the pool is smaller and competition tighter. Spending a little more — say £15–£30 — usually buys better quality and far less heartbreak at the glass.

Is this just about Brexit or recent inflation?

Partly, but not entirely. Rising costs in glass, packaging, transport, and energy, plus inflation-linked duty increases, all contribute. Brexit added bureaucracy and delays, but duty is the headline factor for UK prices.

Should I stock up before 1 February?

If you like paying the current rate rather than letting the duty creep, yes. Not because prices will leap overnight, but because once they rise, they rarely drop. A sensible top-up now avoids paying slightly more later.

Where can I find wines that still offer good value?

We’ve got you covered: